The CCS value-chain in the Netherlands

Accelerating the pace of CCS deployment requires continued collaboration between governments, industry and investors, to stimulate technology and infrastructure development, generate demand for lower carbon products, and help unlock financing capacity.

We recognise the scale of the challenge and have the experience to collaborate throughout the value-chain, offering an integrated solution that combines sequestration and transportation from the emitter location to an offshore store.

Achieving climate targets

CCS hubs

Develop commercial CCS hubs that enable decarbonisation and low carbon products

Government relations

Work with governments to help shape their net-zero emission pathways

Working together

Work with customers to help them achieve their own carbon reduction goals and maintain societal license to operate

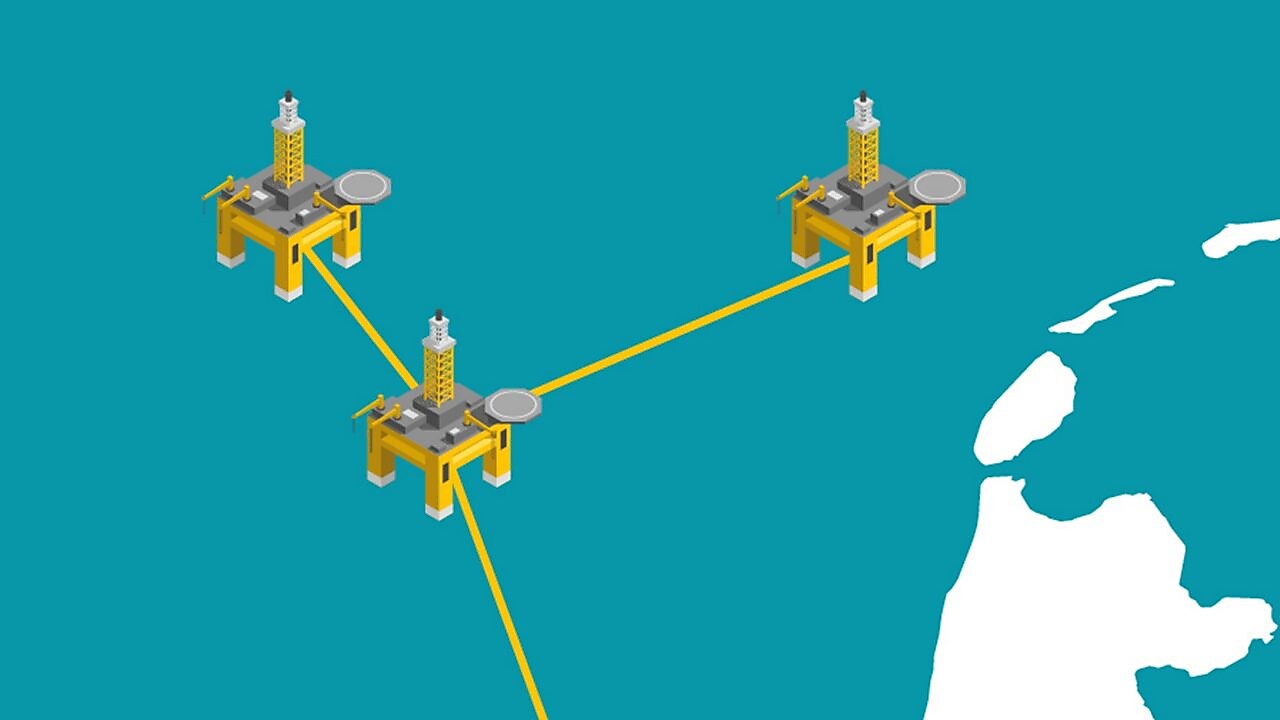

Building CCS Storage capacity in the Netherlands

Aramis Launch Stores project website goes live

News Augustus 2025 — The Launch Stores project unveiled its official website today. The website serves as a central hub for information on the development of the first two offshore CO2 storage sites within the Aramis carbon capture and storage (CCS) value chain. The project is a collaboration between TotalEnergies and Shell and has received financial support from the European Union’s Innovation Fund.

The website provides a comprehensive overview of the Launch Stores project and serves as the main portal for updates, background information and progress reports. This unveiling follows a major milestone reached earlier this year: the award of a €118 million grant from the EU Innovation Fund.

European Innovation Fund grant

The EU funding supports the development of two CO2 storage sites, L4A (TotalEnergies) and K14 (Shell), which together will demonstrate the viability of commercial-scale injection of liquid CO2 into depleted gas fields. This funding was awarded in recognition of the project’s innovative CO2 storage technologies, as well as its process and business case innovations.

CO2 storage capacity

The Launch Stores project, with a combined CO2 storage capacity of 5 million tonnes per annum (Mtpa), is key to building the Aramis CCS infrastructure. With an overall planned CO2 transport capacity of 22 Mtpa, Aramis will enable hard-to-abate industries across Northwest Europe to access a safe, reliable and effective emissions -reduction solution.

Major step towards 2030 climate targets

The funding also recognises the Launch Stores project’s potential contribution to meeting the 2030 climate goals set by the Dutch Climate Agreement and the EU Green Deal, particularly those outlined in the EU's Industrial Carbon Management Strategy and the Net-Zero Industry Act.

Visit the new website to learn more about the Aramis Launch Stores project — a collaboration between Shell and TotalEnergies — and discover how CO2 storage in depleted gas fields is helping drive large-scale CCS for a more sustainable future:

Shell intends to investigate CO₂ storage in aquifers under the Dutch North Sea

News September 2024: Exciting news for the development of CO2 storage in aquifers in the Netherlands! After being awarded the exploration license for the so-called P&O blocks in May, Shell Offshore Carbon Storage NL (SOCS NL) has also been granted an exploration license for the K block aquifers.

The exploration license covers an area of over 1200 km² in the Dutch North Sea (K08a, K10a, K11a, K12a, K13a, K14a, K14b, K15a, K15b, K17a) and is located approximately 100 km northwest of Den Helder.

CO2 storage in aquifers can make an important contribution to the Dutch and European climate targets. SOCS NL is working hard to develop a better understanding of the storage capacity in aquifers in the Dutch part of the North Sea.

News May 2024: Shell Offshore Carbon Storage NL (SOCS NL) has been granted an exploration license for the storage of CO2 in so-called saline aquifers under the North Sea. Aquifers are saltwater-bearing layers in the deep subsurface that have the potential to store CO2. The aim of the exploration program is to find out whether aquifers could complement depleted gas fields as another means of CO2 storage in the Netherlands.

The exploration license covers almost 1500 km2 in the so-called P&O Blocks, which are located approximately 15 km off the Dutch coastline near the Maasvlakte. SOCS NL intends to investigate the storage of CO2 in aquifers in the Dutch part of the North Sea to help understand the costs of storing CO2 in aquifers and to develop the Netherlands’ expertise in this area.

Carbon capture and storage (CCS) is a technology that can help to achieve national and European climate goals. CO2 storage in saline aquifers is currently successfully carried out by Shell and others in places like Canada, Australia and Norway. At the moment, the Netherlands is working hard to develop the infrastructure to transport captured CO2 through Porthos, Aramis and the Delta Rhine Corridor.

Shell's first Aramis CO₂ storage field (K14FA) moves to next phase

News November 2023: The K14FA store is part of Aramis Launch project scope and will be one of the first stores to receive CO₂ once the Aramis transport system is expected to be operational in 2028. The K14FA store has reached the front-end engineering and design (FEED) stage – an important milestone which will progress the technical design of the store.

Working together with governments and industry

Accelerating the pace of CCS deployment requires continued collaboration between governments, industry and investors to stimulate technology and infrastructure development, generate demand for lower carbon products, and help unlock financing capacity.

We recognise the scale of the challenge and have the experience to collaborate throughout the value-chain, offering an integrated solution that combines sequestration and transportation from an emitter's location to an offshore store.

Accelerating the transition to net-zero

It is not just about technology and available infrastructure. Regulations and policies are also required:

- A regulatory regime that promotes high standards for the design, construction and operation of CCS facilities

- Cross-border agreements on CO2 transport and storage

- Common standards across countries to facilitate trading of CCS credits

- Transparent processes for permitting and licensing across CCS value chains

- Government incentives for CCS projects

- Creation of demand for low-carbon products through public procurement processes

- Recognition of certified Carbon Dioxide Removal (CDR) units for compliance purposes and ETS framework

Project information

Featured Content

Cautionary Note

Cautionary Note

The companies in which Shell plc directly and indirectly owns investments are separate legal entities. In this content “Shell”, “Shell Group” and “Group” are sometimes used for convenience where references are made to Shell plc and its subsidiaries in general. Likewise, the words “we”, “us” and “our” are also used to refer to Shell plc and its subsidiaries in general or to those who work for them. These terms are also used where no useful purpose is served by identifying the particular entity or entities. ‘‘Subsidiaries’’, “Shell subsidiaries” and “Shell companies” as used in this content refer to entities over which Shell plc either directly or indirectly has control. Entities and unincorporated arrangements over which Shell has joint control are generally referred to as “joint ventures” and “joint operations”, respectively. “Joint ventures” and “joint operations” are collectively referred to as “joint arrangements”. Entities over which Shell has significant influence but neither control nor joint control are referred to as “associates”. The term “Shell interest” is used for convenience to indicate the direct and/or indirect ownership interest held by Shell in an entity or unincorporated joint arrangement, after exclusion of all third-party interest.

Forward-Looking Statements

This content contains forward-looking statements (within the meaning of the U.S. Private Securities Litigation Reform Act of 1995) concerning the financial condition, results of operations and businesses of Shell. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. Forward-looking statements are statements of future expectations that are based on management’s current expectations and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in these statements. Forward-looking statements include, among other things, statements concerning the potential exposure of Shell to market risks and statements expressing management’s expectations, beliefs, estimates, forecasts, projections and assumptions. These forward-looking statements are identified by their use of terms and phrases such as “aim”, “ambition”, ‘‘anticipate’’, ‘‘believe’’, ‘‘could’’, ‘‘estimate’’, ‘‘expect’’, ‘‘goals’’, ‘‘intend’’, ‘‘may’’, “milestones”, ‘‘objectives’’, ‘‘outlook’’, ‘‘plan’’, ‘‘probably’’, ‘‘project’’, ‘‘risks’’, “schedule”, ‘‘seek’’, ‘‘should’’, ‘‘target’’, ‘‘will’’ and similar terms and phrases. There are a number of factors that could affect the future operations of Shell and could cause those results to differ materially from those expressed in the forward-looking statements included in this content, including (without limitation): (a) price fluctuations in crude oil and natural gas; (b) changes in demand for Shell’s products; (c) currency fluctuations; (d) drilling and production results; (e) reserves estimates; (f) loss of market share and industry competition; (g) environmental and physical risks; (h) risks associated with the identification of suitable potential acquisition properties and targets, and successful negotiation and completion of such transactions; (i) the risk of doing business in developing countries and countries subject to international sanctions; (j) legislative, judicial, fiscal and regulatory developments including regulatory measures addressing climate change; (k) economic and financial market conditions in various countries and regions; (l) political risks, including the risks of expropriation and renegotiation of the terms of contracts with governmental entities, delays or advancements in the approval of projects and delays in the reimbursement for shared costs; (m) risks associated with the impact of pandemics, such as the COVID-19 (coronavirus) outbreak; and (n) changes in trading conditions. No assurance is provided that future dividend payments will match or exceed previous dividend payments. All forward-looking statements contained in this content are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Readers should not place undue reliance on forward-looking statements. Additional risk factors that may affect future results are contained in Shell plc’s Form 20-F for the year ended December 31, 2022 (available at www.shell.com/investor and www.sec.gov). These risk factors also expressly qualify all forward-looking statements contained in this content and should be considered by the reader. Each forward-looking statement speaks only as of the date of publication mentioned on this website. Neither Shell plc nor any of its subsidiaries undertake any obligation to publicly update or revise any forward-looking statement as a result of new information, future events or other information. In light of these risks, results could differ materially from those stated, implied or inferred from the forward-looking statements contained in this content.

Shell’s net carbon footprint

Also, in this content we may refer to Shell’s “Net Carbon Intensity”, which includes Shell’s carbon emissions from the production of our energy products, our suppliers’ carbon emissions in supplying energy for that production and our customers’ carbon emissions associated with their use of the energy products we sell. Shell only controls its own emissions. The use of the term Shell’s “Net Carbon Intensity” is for convenience only and not intended to suggest these emissions are those of Shell plc or its subsidiaries.

Shell’s net-Zero Emissions Target

Shell’s operating plan, outlook and budgets are forecasted for a ten-year period and are updated every year. They reflect the current economic environment and what we can reasonably expect to see over the next ten years. Accordingly, they reflect our Scope 1, Scope 2 and Net Carbon Intensity (NCI) targets over the next ten years. However, Shell’s operating plans cannot reflect our 2050 net-zero emissions target and 2035 NCI target, as these targets are currently outside our planning period. In the future, as society moves towards net-zero emissions, we expect Shell’s operating plans to reflect this movement. However, if society is not net zero in 2050, as of today, there would be significant risk that Shell may not meet this target.

Forward Looking Non-GAAP measures

This content may contain certain forward-looking non-GAAP measures such as cash capital expenditure and divestments. We are unable to provide a reconciliation of these forward-looking Non-GAAP measures to the most comparable GAAP financial measures because certain information needed to reconcile those Non-GAAP measures to the most comparable GAAP financial measures is dependent on future events some of which are outside the control of Shell, such as oil and gas prices, interest rates and exchange rates. Moreover, estimating such GAAP measures with the required precision necessary to provide a meaningful reconciliation is extremely difficult and could not be accomplished without unreasonable effort. Non-GAAP measures in respect of future periods which cannot be reconciled to the most comparable GAAP financial measure are calculated in a manner which is consistent with the accounting policies applied in Shell plc’s consolidated financial statements.

The contents of websites referred to in this content do not form part of this content.

We may have used certain terms, such as resources, in this content that the United States Securities and Exchange Commission (SEC) strictly prohibits us from including in our filings with the SEC. Investors are urged to consider closely the disclosure in our Form 20-F, File No 1-32575, available on the SEC website www.sec.gov.